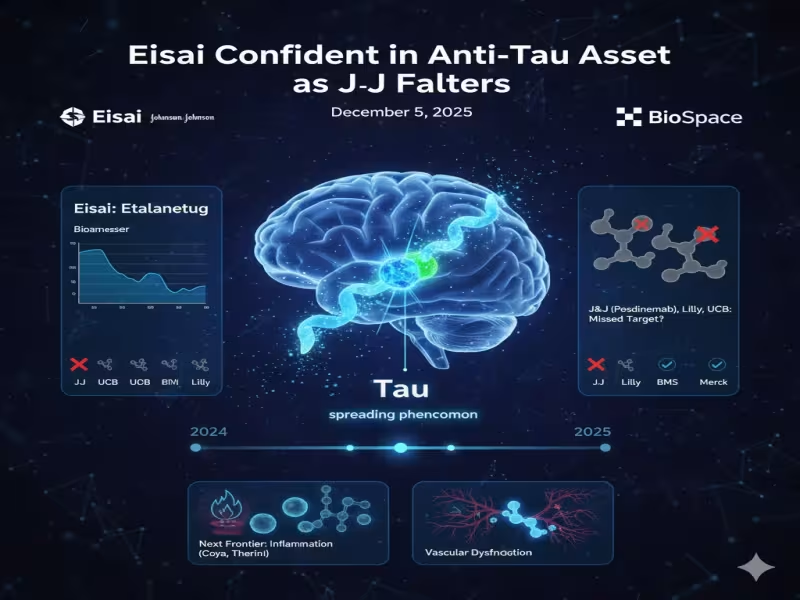

SHERIDAN, WYOMING - December 8, 2025 - Days after Johnson & Johnson reported a mid-stage failure for its anti-tau antibody posdinemab, Eisai is using the Clinical Trials on Alzheimer's Disease (CTAD) 2025 conference to argue that tau is still a viable target-if drug designers hit the right part of the protein-while investors and scientists pivot their attention to inflammation and vascular pathways.

Anti-tau Setbacks Raise the Bar for New Entrants

Tau-directed drugs have been among the most high-profile disappointments in Alzheimer's disease (AD) R&D. J&J's recent miss with posdinemab follows last year's Phase II failure of UCB's bepranemab and Eli Lilly's inability to replicate its amyloid success with the anti-tau candidate LY3372689. Collectively, these readouts have fed a narrative that tau may be an intractable or poorly understood target for disease modification.

Against this backdrop, Eisai Chief Clinical Officer Lynn Kramer is pushing back on the idea that tau itself is the problem. In an interview ahead of CTAD, he argued that many earlier programs were simply aimed at the wrong epitope. "We've never expected them to succeed because if you don't have the right target you can't succeed," he said, pointing out that J&J's antibody "doesn't hit that seeding region" of tau believed to drive pathological spread.

Etalanetug: Targeting Tau's Seeding Core

Eisai's lead tau asset, etalanetug, is designed specifically to bind the R2-R4 regions within the microtubule binding region (MTBR) of tau, which Kramer describes as "critical" for its ability to seed and propagate pathology. In an oral presentation at CTAD, the company shared Phase Ib/II data showing that etalanetug reduced all measurable forms of MTBR-tau243-a biomarker closely tied to tangle burden-in cerebrospinal fluid and plasma from seven patients with mild-to-moderate AD.

For Kramer, the mechanistic distinction matters. He argues that etalanetug's binding profile is tailored to interrupt the "spreading phenomenon" that differentiates Alzheimer's from other tauopathies. "[In] almost all tauopathies, tau builds up in the neuron," he said. "It doesn't spread across to the next like an infection." By targeting the seed region, Eisai hopes to blunt that network-level propagation and ultimately translate biomarker changes into cognitive benefit in later-stage trials.

Big Pharma Stays in the Tau Game-with Different Designs

Despite recent failures, Eisai is not alone in betting that better-engineered tau therapeutics can still succeed. Bristol Myers Squibb's BMS-986446 binds to the R1-R3 MTBR regions, while Merck's MK-2214, which targets phosphorylated serine 413 (pS413) tau, recently received FDA fast track designation.

Kramer also maintains that tau remains a superior marker of cognitive impairment compared with amyloid, noting that tau burden tracks better with clinical decline, whereas amyloid levels are similar in cognitively impaired and unimpaired individuals in major trials such as AHEAD 3-45 and CLARITY-AD. Even so, experts caution that clinical validation for tau-directed therapeutics is still limited. Howard Fillit, co-founder and chief science officer at the Alzheimer's Drug Discovery Foundation (ADDF), told BioSpace that much of the current evidence comes from animal models and that "It's still probably a bit early days with anti-tau and anti-tangle therapies."

Inflammation and Vascular Targets Move to Center Stage

One clear theme at CTAD 2025 is that the field is no longer defined solely by amyloid and tau. Fillit points to inflammation-both systemic and neuroinflammation-as the next major frontier. "My personal view is that inflammation is a very important target in this illness, both systemic and neuroinflammation," he said.

Novo Nordisk's semaglutide has already delivered a setback for this hypothesis, failing to slow AD progression in two closely watched trials. Yet more than 30 other anti-inflammatory programs remain active, including Houston-based Coya Therapeutics' Treg-targeted COYA 302 and Therini Bio's THN391, which aims to blunt vascular-driven neuroinflammation by binding an "inflammatory epitope" on fibrin deposits. According to Fillit, while five years ago around 70% of AD trials targeted amyloid and tau, today some 70-75% are aimed at novel pathways, with inflammation leading the charge.

Multiple Pathways, Rising Expectations

The diversification of targets is not leaving amyloid behind. Roche's trontinemab, a bispecific 2+1 amyloid-beta antibody, showed early Phase I/II data at CTAD suggesting potential downstream effects on tau accumulation, even though the drug is not directly tau-directed. For Eisai and Biogen, which already co-market Leqembi, the evolving landscape means that any next-generation tau asset such as etalanetug will need to demonstrate added value on top of amyloid clearance-either via superior efficacy, differentiated safety, or combination potential.

Overall, Fillit characterizes the mood at CTAD 2025 as "very exciting, because we really have breakthroughs and multiple pathways and a lot of drugs in Phase II and even a number in Phase III. Forty years of research is finally paying off." For Alzheimer's pipeline strategists, the message is clear: tau is not dead, but it will have to compete in a far more crowded, multi-pathway therapeutic arena than ever before.

To follow emerging data and company updates on next-generation Alzheimer's mechanisms, consult official communications from Eisai, partner companies and CTAD 2025 conference materials.