SHERIDAN, WYOMING - December 8, 2025 - The U.S. Food and Drug Administration is preparing a fundamental shift in its evidentiary standards for new drugs, with Commissioner Marty Makary signaling that a single pivotal trial could soon be sufficient for approval-a move that has roiled internal leadership, unsettled some regulators and analysts, and triggered immediate recalculations in biopharma portfolio models.

From Two Pivotal Trials to One: A Structural Break

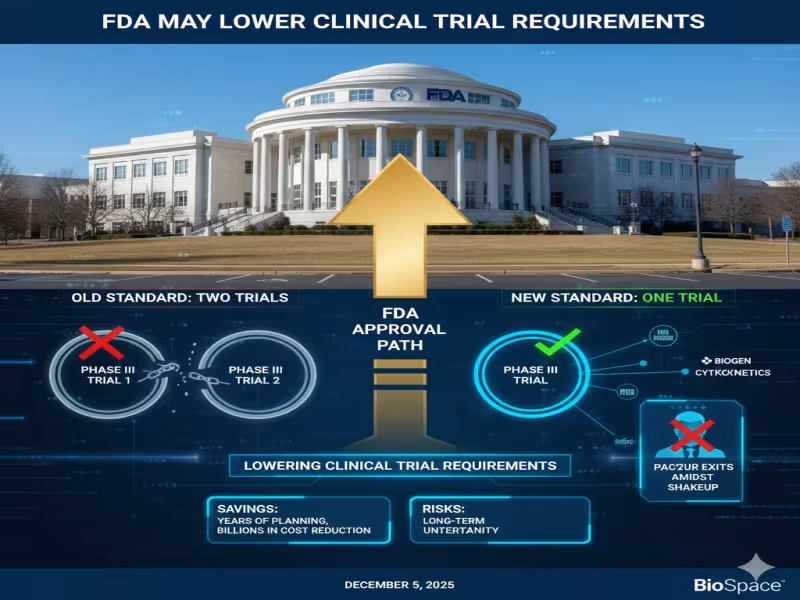

For decades, two adequate and well-controlled pivotal studies have been the de facto gold standard for FDA approval across most indications. Makary now says the agency will "start requiring only one pivotal trial" in many cases, arguing that "you can achieve the same statistical power with one trial as you would with two." The policy is being finalized and is expected within three to six months, setting a near-term clock for sponsors already in, or approaching, late-stage development.

The shift would align formal policy with what has sometimes occurred in practice, especially in rare diseases and high unmet-need indications, where single robust trials or strong Phase II data have supported approvals. The difference now is that a "one-trial standard" would move from exception to expectation, fundamentally changing how companies design Phase III programs and allocate clinical capital.

Internal Fallout: Pazdur's Exit Highlights Tension

The change has also exposed fault lines inside the agency. The push to publicize the one-trial idea is reported to be one factor behind the abrupt retirement of Richard Pazdur, who had only recently taken over as head of the Center for Drug Evaluation and Research (CDER). Pazdur has long been associated with oncology innovation and the expansion of accelerated approval, but also with a strong emphasis on data robustness and post-marketing commitments.

His departure at this juncture underscores how controversial a formal lowering of trial-count expectations can be, even within an FDA that has already shown significant flexibility in recent years. For regulatory affairs leaders and development strategists, the episode is a reminder that policy shifts at the top may be accompanied by internal debate that can shape implementation details over the coming years.

Investors Split Between Enthusiasm and Caution

On the industry side, reactions have ranged from euphoric to cautious. Biopharma consultant David Alderman called the pending policy "the biggest jailbreak in biotech history," arguing that Makary has "dropped a regulatory acceleration warhead in the middle of every portfolio model in the industry." In his view, cutting required pivotal trials from two to one could save sponsors years of planning and billions of dollars, while pulling forward net present value across mid- and late-stage pipelines.

Wall Street's take is more nuanced. Truist analysts acknowledged that a lower threshold could benefit a wide range of companies, especially those with strong existing Phase III data or those operating in indications where multi-trial programs are the norm. They cited Biogen, which could theoretically seek approval for dapirolizumab pegol in systemic lupus erythematosus on the basis of a single positive Phase III trial, and Cytokinetics, whose ulcamten program in heart failure with preserved ejection fraction (HFpEF) might reach the market with one adequately powered Phase III trial "in a space historically requiring multiple large studies."

At the same time, Truist warned of long-term risks associated with lower approval thresholds, particularly in large, heterogeneous indications with multiple existing therapies where historically "stronger evidence" has been expected.

Open Questions for Global Development Strategy

A central uncertainty is how far the new standard will actually stretch. The FDA already allows approvals based on one late-stage study under certain circumstances, particularly when supported by confirmatory secondary endpoints or strong Phase II data. It is not yet clear in which therapeutic areas or risk categories the agency will still insist on two trials, how it will treat highly heterogeneous populations, or whether complex endpoints and marginal effect sizes will trigger demands for additional evidence.

For companies planning global launches, a single U.S. pivotal study may not be enough. Many ex-U.S. regulators-including EMA and key national agencies-are likely to continue expecting multiple large trials, especially for first-in-class drugs in common indications. As Truist noted, sponsors with international ambitions will often run multi-trial programs regardless of FDA policy to satisfy global requirements, generate comparative data and support pricing and reimbursement negotiations.

What Sponsors Should Do Now

In the near term, regulatory and clinical development teams will need to:

- Revisit in-flight and planned Phase III designs to assess whether a single pivotal study plus robust supportive data could suffice for a U.S. filing.

- Model alternative development paths-one global trial versus split regional programs-with an eye on timelines, cost of capital and ex-U.S. evidence expectations.

- Prepare investor communications and risk disclosures that differentiate between theoretical one-trial opportunities and indications where two trials will likely remain the practical standard.

If implemented broadly, the FDA's shift to a one-pivotal-trial paradigm could accelerate time to market for many assets and materially alter how pipelines are structured. Yet with internal dissent, external skepticism and global regulatory realities in play, sponsors will need to treat this as an opportunity that still demands cautious, indication-specific strategy rather than a blanket shortcut to approval.

For official updates and detailed regulatory guidance as this policy is finalized, visit the U.S. Food and Drug Administration's website.