SHERIDAN, WYOMING - December 8, 2025 - Global business districts are regaining their pull as hubs for capital, talent and innovation, even as they face structural shifts from hybrid work, rising costs and climate pressures, according to the new "Global Business Districts Attractiveness Report 2025" by EY, the Urban Land Institute (ULI) and the Global Business Districts (GBD) Innovation Club. The study again crowns New York as the world's leading hub while placing Frankfurt's banking district in the global top ten and at number one worldwide for sustainability.

New York Leads, Frankfurt Enters Top Ten as Europe Loses Ground on Scale

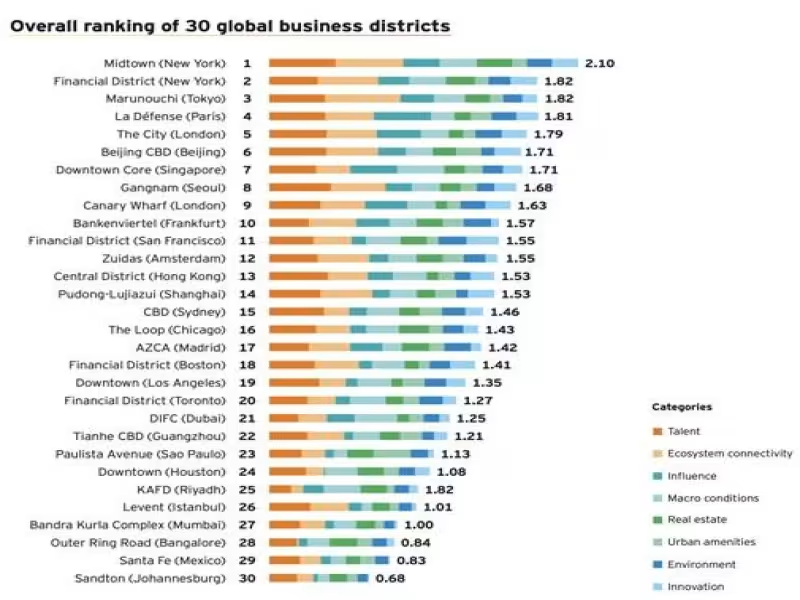

The third edition of the report assesses 30 leading global business districts (GBDs) across 19 countries, benchmarked against 2,400 data points and eight indicators, including macroeconomic performance, talent, innovation, real estate and sustainability. Together, these districts generate around USD 4.5 trillion in GDP annually, employ more than seven million people and host 84 Global Fortune 500 companies and 296 headquarters.

Historically dominant locations remain at the top: New York's Midtown and Financial District rank first and second overall, followed by Tokyo Marunouchi (#3), Paris La Défense (#4) and the City of London (#5). Frankfurt's banking district takes tenth place. Yet the global map is shifting: Asian hubs such as Beijing, Singapore and Seoul have moved into the top ten, reflecting the region's growing economic weight and the headwinds facing many North American and European peers, from elevated vacancy to security concerns.

Europe Trails in Competitiveness but Leads on Sustainability

The study highlights a competitiveness gap: Europe's six leading GBDs host 2.5 times fewer Fortune Global 500 headquarters than their Asian counterparts, and investment volumes in 2024 were 60% below Asia-an inversion of the 2020 pattern. At the same time, European districts are out in front on decarbonisation and urban transformation, with Frankfurt and Amsterdam singled out as frontrunners.

Sabine Georgi, Managing Director of ULI in Germany, underlined Frankfurt's dual role: "Frankfurt, with its banking district, rightly ranks among the ten most important global economic centers despite all the challenges of recent years. This underlines the resilience of such districts and their strategic importance for the city.

At the same time, Frankfurt's particularly strong ecological performance shows that climate responsibility and economic success are inseparably linked today, and thus demonstrates that a forward-looking balance between economic strength and ecological responsibility is not only possible but essential in order to remain attractive, resilient and competitive as a modern metropolis."

New Hubs Emerge from Dubai to Bangalore and São Paulo

Alongside the established giants, the report identifies a new wave of districts that could define the next generation of GBDs. In the Middle East, DIFC (Dubai) and KAFD (Riyadh) are capitalising on favourable macro conditions, while in India, Bangalore's Outer Ring Road and Mumbai's Bandra Kurla Complex (BKC) are emerging as major business corridors. Johannesburg, São Paulo and Casablanca are similarly highlighted as rising urban economic cores in their regions.

"Contrary to predictions of their decline, global business districts have adapted and recovered. They remain the nerve centers of economic influence, but their role is continuing to evolve. The most successful and resilient will be those that constantly change and combine commercial vitality with climate responsibility and multifunctional, human experiences," said Simon Chinn, Vice President Research & Advisory Services, ULI Europe.

Four Megatrends Reshaping Global Business Districts

The EY/ULI study points to four megatrends that will define how GBDs compete over the next decade:

- Talent first - 76% of executives cite talent attraction as their top location criterion. Mixed-use, liveable districts with green spaces, culture, retail and affordable housing are becoming essential as GBDs shift from pure office clusters to full urban environments.

- The "soft and hard power" of real estate - Fair value is now central to strategy, with 40% of users naming it a priority. Prime buildings that are accessible, energy-efficient and technologically equipped still command higher rents in markets like the City of London (+40% since 2019) and Midtown Manhattan (+30%), as companies pay for quality and sustainability. "Companies are willing to pay a premium for quality and sustainability, but hybrid working has changed the definition of 'prime'. Flexibility, accessibility and a strong sense of identity are now just as decisive as the rent," said Marc Lhermitte, Partner at EY.

- Technology's double role and the "unicorn gap" - While 27% of leaders see AI as a critical progress factor and 42% call for tighter science-business collaboration, only 12% of global unicorns are headquartered in GBDs, raising the risk that innovation migrates to more agile clusters. Best-practice districts such as Singapore's Marina Bay, Paris La Défense and Beijing CBD are using IoT, 5G, AI and digital twins to manage mobility, energy, emissions and safety.

- The complexity of sustainability - Mobility decarbonisation, deep retrofits and green-blue infrastructure are seen as the three main levers, but fewer than 10% of respondents believe GBDs are on track across these dimensions. In the sustainability ranking, Frankfurt's banking district leads, followed by San Francisco's Financial District and the City of London.

From Business Districts to "Central Social Districts"

Looking ahead, the report predicts that many GBDs will evolve into "Central Social Districts" (CSDs): inclusive, mixed-use cores that integrate work, living, culture and climate resilience. Recommendations include a people-first approach to talent attraction, adaptive reuse of assets, deeper adoption of AI and smart infrastructure, strong "triple-helix" cooperation between business, academia and start-ups, and embedding climate commitments into planning and governance.

"We are pleased to see major business districts worldwide entering a new phase of dynamic growth. They are showing strong momentum in talent concentration, business strength, innovation development and sustainable transformation. Today, business districts are not only engines of economic growth but also innovation laboratories and prototypes for the cities of the future. We are transforming ourselves from traditional office locations into more inclusive and resilient urban cores and creating new momentum for economic and talent development," said Chen Dai, Chair of the Global Business Districts Innovation Club and Director of the Administrative Committee of the Beijing Central Business District.

For more information and access to the Global Business Districts Attractiveness Report 2025, visit germany.uli.org.