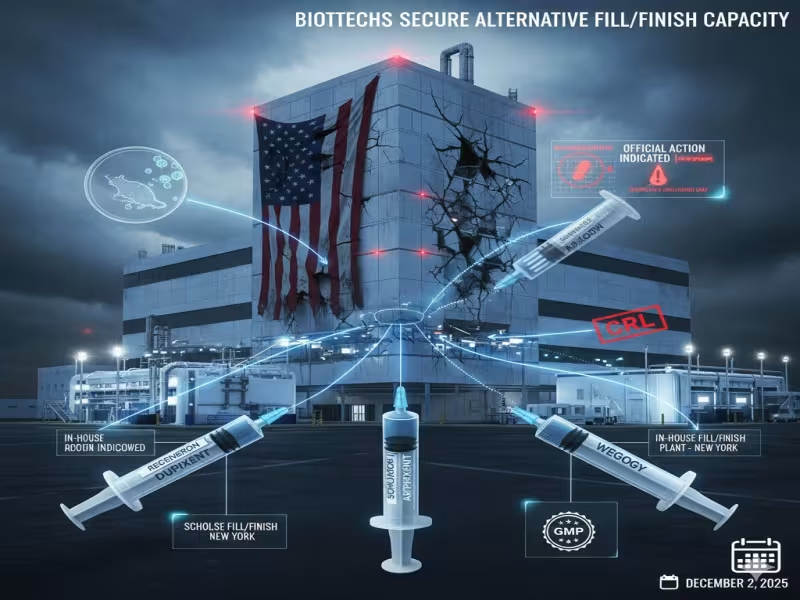

SHERIDAN, WYOMING - December 2, 2025 - A series of FDA findings at Novo Nordisk's Bloomington, Indiana, fill/finish facility is forcing biotechs to rethink their commercial manufacturing strategies, with Regeneron and Scholar Rock now accelerating alternative capacity plans to break regulatory logjams linked to the ex-Catalent site.

FDA scrutiny at Novo's Bloomington site triggers CRLs

The Bloomington plant, one of three former Catalent sites Novo acquired for $11 billion to support surging GLP-1 demand, has become a bottleneck rather than a release valve for some of its biopharma customers. As a CDMO hub, the facility provided fill/finish services for a range of partners, but repeated quality issues have resulted in an Official Action Indicated (OAI) classification and multiple complete response letters (CRLs) from the FDA.

Regeneron has been hit by a "series of complete response letters" since 2023 tied to FDA observations at the Indiana site, while Scholar Rock received its own CRL in September. The impact may extend beyond these publicly disclosed cases. On an October earnings call, Regeneron CEO Leonard Schleifer said "the biggest companies in the world have had the same issue" at this and other fillers but chose not to disclose their CRLs.

Novo is working through a remediation plan and moving toward reinspection, but the clock is ticking for its clients. Scholar Rock disclosed on December 2 that the Bloomington facility has now received an FDA warning letter-raising the stakes for companies still reliant on the site for key commercial programs.

Scholar Rock fast-tracks a second U.S. fill/finish partner

For Scholar Rock, the OAI designation and CRL for its spinal muscular atrophy (SMA) candidate apitegromab were catalysts to accelerate diversification. On a November earnings call, CEO David Hallal said his team "accelerated our timelines for an additional vialer" after the OAI classification. The biotech had already begun exploring an additional U.S.-based partner following Novo's acquisition of the plant, but it pulled that work forward in response to the regulatory setback.

Scholar Rock has now secured commercial fill/finish capacity beginning in early 2026, with the new provider having recently passed site inspections. Tech transfer is underway, and the plan is to include the facility in an approval filing in 2026. BMO Capital Markets analysts responded by raising the probability of success for apitegromab in SMA to 80%, noting that, "As we have seen throughout 2025, the more biotech manufacturers can plan for unforeseen CMC issues, the less likely they are to face challenges with FDA approvals," and adding that "Scholar Rock's expedited transfer for this second fill finish acknowledges this reality and could provide comfort for investors who still are wary of another Catalent site reinspection."

Novo, for its part, is not standing still. Hallal said Novo representatives joined Scholar Rock at a November FDA meeting and "detailed the progress they have made in implementing their remediation plan at the Bloomington facility." Novo indicated it expects the site to be ready for reinspection by year-end, even as the warning letter underscores the seriousness of outstanding issues.

Regeneron builds in-house resilience in Rensselaer

Regeneron is taking a different route to supply-chain resilience by bringing fill/finish in-house. Schleifer told investors in October that a new plant is "ready to go, and we expect it to come online during the coming year." A company spokesperson later confirmed the reference was to a facility in Rensselaer, New York, part of a broader $7 billion investment package unveiled in April.

At a September Morgan Stanley event, Schleifer said the facility will open with one line, initially taking back some Dupixent filling currently handled by partner Sanofi. Over time, Regeneron expects to scale up to four lines to cover internal demand. The move responds directly to criticism that the company has been overly exposed to third-party CMC problems. Schleifer conceded it would "be more ideal if we could have our own filling," but said those efforts were "delayed dramatically during COVID."

He also highlighted how slow it can be to add back-up CDMO capacity: "We've been working on backups for quite a long time now," he said, explaining that "the FDA is very finicky about showing where you're going to make the product, literally what equipment it's going to touch. Then you have to do stability testing and . . . quality testing-all that for a given filler. That takes quite a bit of time, quite a bit of resources."

Eylea HD approval signals tentative regulatory improvement

Regeneron's complexity around fillers was on full display in the run-up to the Eylea HD biologics license application. As of mid-November, CFO Christopher Fenimore warned that "if there is no compliant filler on the BLA, and really the only one that it could be at this point is Catalent, we would expect to get a CRL." Yet just two days later, the FDA approved Eylea HD in macular edema after retinal vein occlusion and for monthly dosing across approved indications.

The company has not disclosed what changed in the final stretch and declined to elaborate beyond its press release, which noted continuing work with the ex-Catalent site to resolve issues blocking approval of a prefilled syringe version. BMO analysts described the Eylea HD approval as "a welcome surprise as regulatory issues are starting to show signs of improvement," but added that a further test is imminent as Regeneron plans to refile the prefilled syringe BLA in January, contingent on validating a new third-party filler.

Strategic lessons for biotechs managing CMC and CDMO risk

For manufacturing and CMC leaders, the saga around Novo's Bloomington facility is a case study in how CDMO quality issues can ripple through portfolios and timelines. The experiences of Scholar Rock and Regeneron highlight several practical lessons: build redundancy into fill/finish networks early, assume remediation timelines will be longer than expected, and factor FDA's stringent expectations for site-specific validation into launch planning.

As more biologics sponsors rely on external partners for sterile fill/finish, strategic decisions about when to bring capacity in-house, how to diversify vialers and how aggressively to pursue tech transfer will increasingly shape regulatory risk and investor confidence. Even as Novo works to bring its Indiana site back into full compliance, biotechs are clearly signaling that long-term resilience requires options beyond a single high-throughput plant-no matter who owns it.

For additional detail on these manufacturing strategies and regulatory interactions, stakeholders should refer to the companies' official earnings calls, regulatory filings and publicly available disclosures.