SHERIDAN, WYOMING - December 2, 2025 - As several large pharmas pull back from cell therapy, a core group of biopharma players is doubling down on CAR T and next-generation approaches, positioning themselves to capture long-term value in oncology and autoimmune disease even as near-term sentiment cools.

Big pharma exits reshape expectations, not potential

Over the past year, the cell therapy field has seen a string of high-profile retreats. Takeda halted new investments in the modality and is offloading its pipeline and platforms after more than eight years of heavy spending. Novo Nordisk followed by terminating all cell therapy work, including a type 1 diabetes program, with nearly 250 roles cut. Belgian biotech Galapagos also shut down its cell therapy business after failing to find a buyer.

Earlier, Cargo Therapeutics abandoned development of its lead firi-cel program after an ad-hoc analysis raised doubts about its clinical profile, leading to a drastic headcount reduction. Vertex likewise halted a cell therapy-device combo for type 1 diabetes. Yet interest from clinicians and researchers remains strong: at the 2025 meeting of the American College of Rheumatology, educational sessions on cell therapies-particularly CAR Ts-were "standing room only," Lynelle Hoch, president of Bristol Myers Squibb's Cell Therapy Organization, told BioSpace.

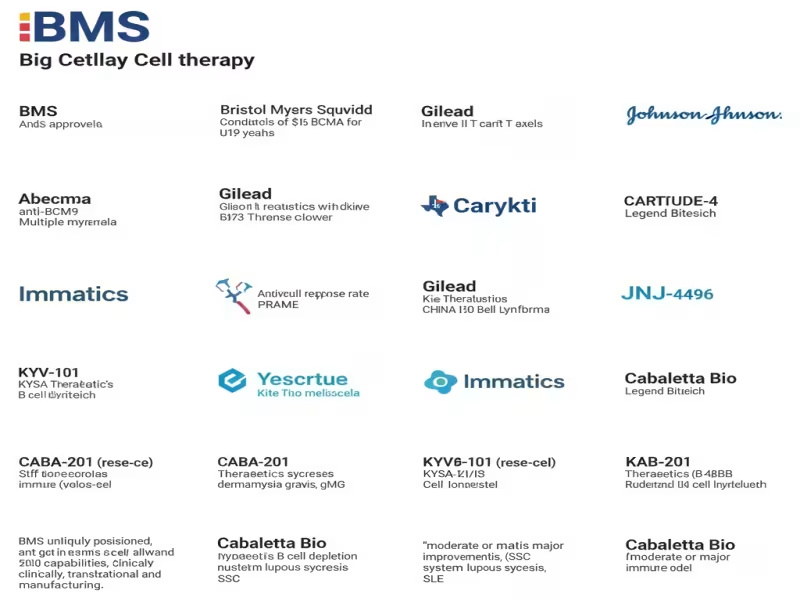

BMS, Gilead and J&J extend their CAR T leadership

For Bristol Myers Squibb, the current environment is a reason to consolidate, not retreat. "I can't speak to why other companies are bailing," Hoch said, but for BMS, there are plenty of reasons to stay. "BMS is uniquely positioned," she continued. "We got in early and getting in early allowed us to build capabilities clinically, translationally and [in] manufacturing."

BMS is one of the few companies with FDA-approved cell therapies and the only one with two CAR Ts against different targets:

- Abecma (anti-BCMA) for relapsed or refractory multiple myeloma

- Breyanzi (anti-CD19) across several blood cancers

The company is also investing in in vivo reprogramming, paying $1.5 billion to acquire Orbital Therapeutics and its RNA platform, and is exploring CAR Ts in autoimmune indications.

Gilead, via Kite, is likewise building for the long term. In addition to two approved CD19-directed products-Yescarta and Tecartus-the company is pushing deeper into in vivo CAR T through deals with Pregene and Interius BioTherapeutics. Its BCMA-directed anitocabtagene autoleucel (anito-cel), partnered with Arcellx, delivered a 97% overall response rate and 68% complete/stringent response rate in mid-stage multiple myeloma data.

Johnson & Johnson rounds out the big-pharma CAR T leaders with Carvykti, a BCMA-targeting therapy for relapsed or refractory multiple myeloma that generated $963 million in worldwide sales last year and is rapidly catching BMS's myeloma franchise. Phase III CARTITUDE-4 data showed 89% of treated patients had no detectable cancer cells at three years' median follow-up, and J&J is advancing follow-on asset JNJ-4496, which hit a 100% objective response rate in early large B cell lymphoma data.

Immatics targets PRAME as a pan-cancer opportunity

Germany- and Texas-based Immatics is carving out a differentiated position around the cancer-testis antigen PRAME, expressed in more than 50 tumor types and minimally in healthy tissue. Lead T cell therapy anzu-cel is in the Phase III SUPRAME trial as a second-line option for cutaneous melanoma, with progression-free and overall survival as key endpoints and an FDA filing targeted for the first half of 2027.

Immatics has also reported encouraging Phase Ib data for anzu-cel in uveal melanoma, with a 67% confirmed objective response rate and 88% disease control rate, and has opened a Phase II cohort in this indication in the U.S. and Germany. In parallel, the company is working with Moderna on combinations of anzu-cel and mRNA-4203 in cutaneous melanoma and synovial sarcoma, underscoring the strategic push to integrate cell therapies with mRNA platforms.

Kyverna sets a new efficacy bar in autoimmune CAR T

Kyverna Therapeutics is one of the most closely watched players in autoimmune cell therapy. Its CD19-directed KYV-101 uses a National Institutes of Health-designed CAR construct optimized for tolerability, with dual engagement of CD19 and CD28 to drive deep B-cell depletion and treat the root cause of B-cell-mediated diseases.

In generalized myasthenia gravis, early Phase II/III KYSA-6 data showed a 100% response rate in six heavily pretreated patients with moderate to severe disease. William Blair analysts described KYV-101 as setting "a new efficacy standard in the field" and noted that the magnitude of benefit makes it "differentiated from current therapies and other late-stage assets." Kyverna plans to transition KYSA-6 into a Phase III registrational study and is pursuing an expansive pipeline in stiff person syndrome, lupus nephritis, multiple sclerosis, rheumatoid arthritis and systemic sclerosis, with key readouts and an FDA filing targeted over the next two years.

Cabaletta builds an 'immune system reset' franchise

Cabaletta Bio is pursuing a similar vision with its sole asset CABA-201 (resecabtagene autoleucel, rese-cel), a CD19-directed CAR T engineered with a 4-1BB co-stimulatory domain designed to completely but temporarily deplete B cells and trigger an "immune system reset."

The company is advancing rese-cel across a broad autoimmune portfolio, with Phase I/II programs in dermatomyositis and antisynthetase syndrome under the RESET-Myositis banner, where six treated patients showed "moderate or major improvement" 16 weeks after therapy without background immunomodulators. Early data also indicate SLE remission and complete renal response in lupus nephritis, alongside clinically meaningful benefits in systemic sclerosis. Cabaletta is now aligning with the FDA on pivotal trial designs and is extending rese-cel into gMG, multiple sclerosis and pemphigus vulgaris.

Strategic outlook: consolidation, focus and cross-disease expansion

Taken together, these six companies illustrate a selective but determined commitment to cell therapy. While some peers exit under the weight of cost, complexity and clinical risk, BMS, Gilead, J&J, Immatics, Kyverna and Cabaletta are concentrating capital on indications and mechanisms where CAR T and related modalities can deliver clear clinical differentiation and durable value. Their ability to manage manufacturing, safety and access questions-while pushing into autoimmune and pan-cancer settings-will determine whether the next phase of cell therapy becomes a niche consolidation or a renewed growth story.

For more detailed information on individual cell therapy programs and clinical data, stakeholders should consult the respective companies' official communications and regulatory filings.